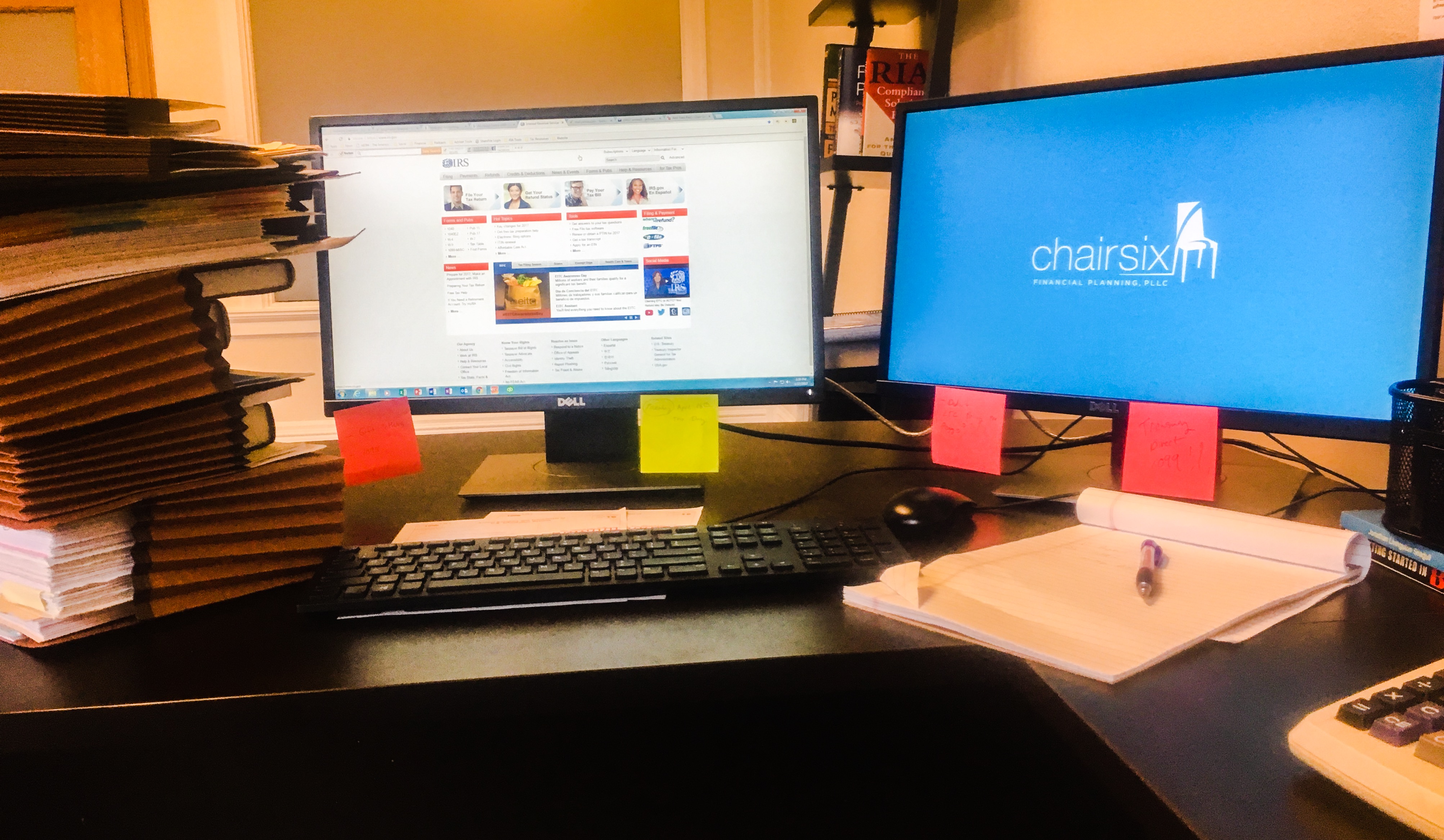

28 Jul Reasonable Compensation for S Corporation Shareholder/Employees

A driving force behind the decision to be taxed as an S corporation as opposed to a partnership or disregarded entity is the potential for reducing self-employment taxes. Partners in a partnership or members in an LLC (and sole-proprietors) who provide services to their business...